Understand the FIRE movement and learn practical steps to achieve financial independence. Save more, invest smarter, and plan for early retirement with actionable strategies.

Picture this: it’s a weekday morning. Instead of rushing through traffic, you’re sipping coffee at home, planning your next travel or passion project. You’re not bound by a paycheck, your money is working for you. That’s the essence of FIRE, or Financial Independence, Retire Early - a movement that’s not about escaping work but reclaiming time and choice.

In a world where burnout is common and “someday” dreams are often postponed, FIRE offers a radical but practical alternative: save aggressively, invest wisely, and achieve financial independence decades before the traditional retirement age.

FIRE is built on two simple goals:

The concept took off in the U.S. in the 1990s and has found new life among India’s urban workforce - especially millennials and Gen Z professionals who value flexibility over lifelong employment.

At its heart, FIRE revolves around one key formula:

Annual Expenses × 25 = Target Corpus

This is called the Rule of 25.

If your annual expenses are ₹10 lakh, you’ll need around ₹2.5 crore invested to retire comfortably. Why? Because, assuming a 4% annual withdrawal rate, your investments can sustain you indefinitely - provided they continue earning returns at or above inflation.

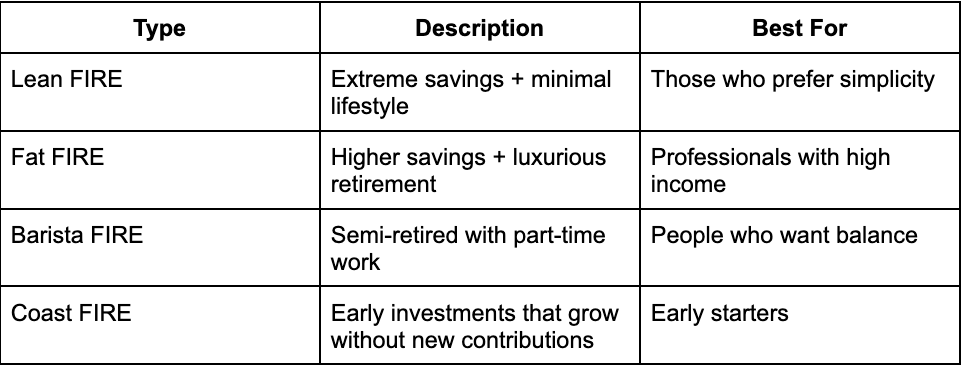

Not everyone follows the same path. FIRE adapts to lifestyles:

Your version of FIRE depends on your comfort level, and your willingness to trade present spending for future freedom.

1. Track Every Rupee You Spend

You can’t plan what you don’t measure. Use any personal finance tracker to categorize your monthly expenses - essentials, wants, and savings. Aim for the 50-30-20 rule, or even 70-20-10 if you want to accelerate FIRE.

2. Save Aggressively, But Smartly

Most FIRE followers save 40–60% of their income. It sounds tough, but automating savings helps. The moment your salary hits, route a fixed amount to investments and emergency funds before you start spending.

3. Build a Strong Investment Portfolio

Your FIRE corpus should grow faster than inflation. Here’s a balanced approach:

SalarySe offers FDs with up to 8.15% returns - a great way to balance your high-growth assets with low-risk stability.

4. Increase Income Streams

Relying solely on one salary can slow your journey. Consider:

Multiple income sources accelerate savings and reduce risk.

5. Stay Debt-Free

Credit card debt or high-interest loans are FIRE killers. Use Credit-on-UPI products like the SalarySe RuPay Credit Card wisely - pay on time, earn cashback, and avoid paying interest.

6. Reinvest Your Gains

Every dividend, bonus, or raise should feed your investment pool, not your lifestyle. Compounding needs time and consistency.

7. Redefine “Retirement”

FIRE isn’t about quitting work forever, it’s about freedom. Many who reach financial independence use it to switch careers, start businesses, or pursue passion projects. The goal isn’t inactivity; it’s autonomy.

FIRE isn’t about depriving yourself. It’s about designing a life where money no longer controls your choices. It’s about peace, knowing your future is funded, your risks are managed, and your dreams are not delayed.

So, whether you want to retire at 45 or simply gain more freedom in your 30s, the first step is awareness, and the next is action. Start tracking your money, invest early, stay consistent, and when the time comes, you’ll find that your financial independence isn’t a dream. It’s your reality.

Explore smart savings and fixed deposits on the SalarySe App - where your salary starts working as hard as you do.

SalarySe raises $11.3M to redefine credit access for India’s workforce. Led by Flourish Ventures and SIG Venture Capital, with support from Peak XV Partners and Pravega Ventures, the funding will fuel AI-led innovation, enterprise expansion, and smarter financial solutions for salaried professionals.

As India enters a new interest rate cycle in 2026, fixed deposits are quietly reclaiming their place as a powerful de-risking tool. This blog breaks down how salaried professionals can balance safety and yield, compare FD returns intelligently, and use salary-linked investing to automate wealth creation. A modern guide to making your paycheck work harder - without market stress.

This blog highlights five smart credit card habits to maximize savings and benefits. It covers timely payments to avoid late fees, maintaining a low credit utilization ratio, avoiding costly cash withdrawals, and optimizing reward redemptions.